A Comparison of the Biden and Trump Economic Platforms

This brief provides a side-by-side comparison of the economic platforms of President Biden and former President Trump. It considers policy proposals on taxes and spending, tariffs, regulations, immigration, climate, energy, and considers treatment of the Federal Reserve. The proposals are sourced from the official campaign websites and other official documents and statements of the candidates. It does not consider the economic effects of the two candidates’ proposals and does not address the personal characteristics of the candidates. Since 1992, I have prepared side-by-side comparisons of presidential candidates. More so than in many previous elections, Biden’s and Trump’s stances on select economic policies are not well defined.

Differences and a Few Similarities Between the Two Candidates’ Proposals

On key issues of taxes, spending, and the policies for business, energy, and the environment, the two candidates’ economic platforms present stark alternatives. President Biden’s economic platform is decidedly in the tradition of the Democratic Party, with proposals to increase spending and increase taxes for higher income and wealthier taxpayers, and anti-business provisions. Former President Trump’s proposals are more in the Republican Party mold of lower taxes and restrained spending and are generally more favorable toward business and energy production and negative on green and environmental issues. However, on issues like tariffs, immigration, and regulations, Trump’s platform is less in line with free enterprise Republican traditions. Rather, he pushes systems of central control.

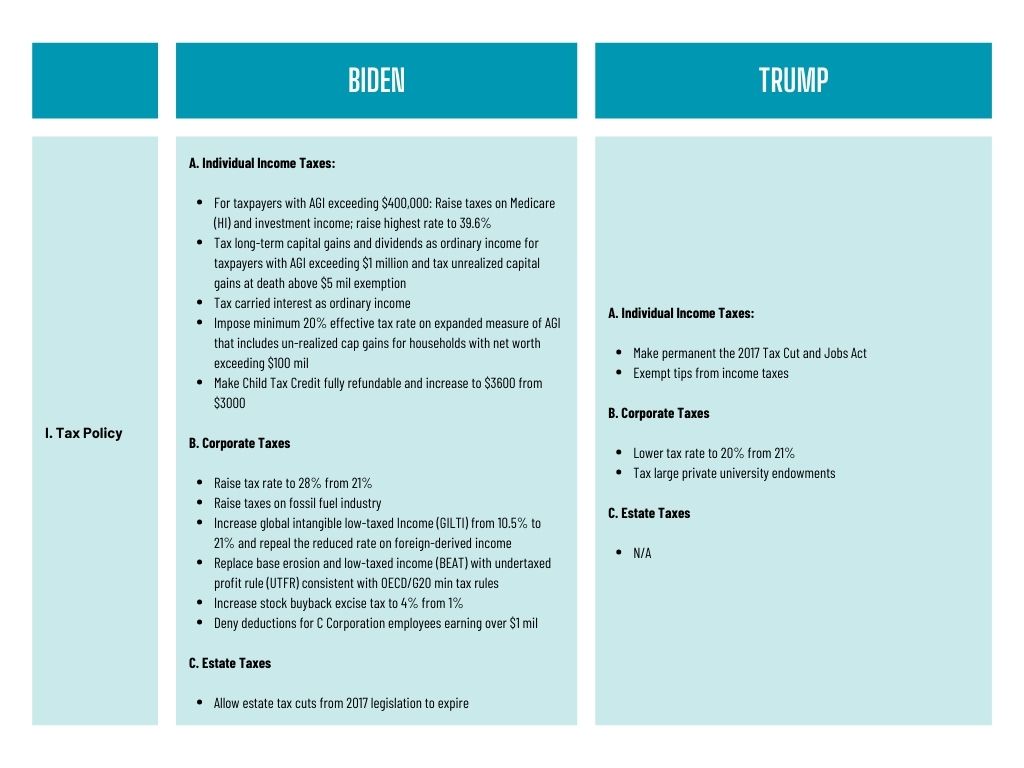

On taxes, Biden proposes sizable tax increases for higher income taxpayers, including higher tax rates and taxes on interest and dividend income and unrealized capital gains of the wealthy, and tax subsidies (credits) for lower income households. Trump proposes to make the 2017 Tax Cuts and Jobs Act, which is set to expire in 2025, permanent, while Biden would allow most provisions of the Act to expire. Trump proposes modest reductions in the corporate tax rate, while Biden proposes increases in corporate taxes and minimum effective taxes on income from overseas and corporate tax rules consistent with OECD and G20 minimums.

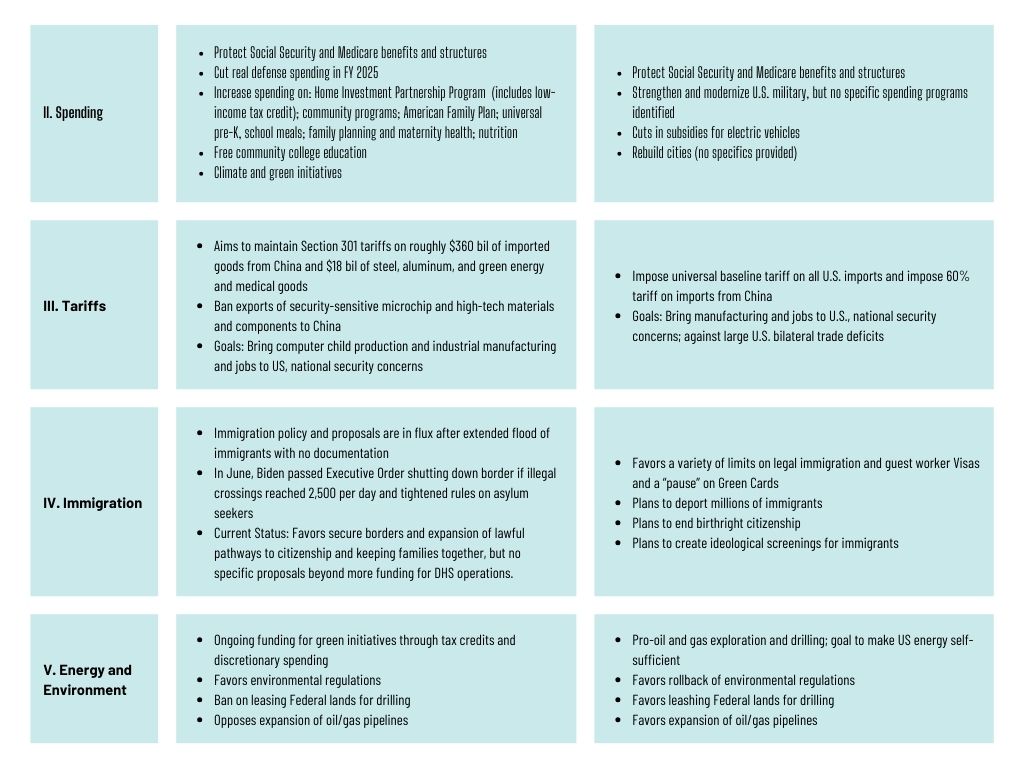

On spending, both candidates explicitly state they would maintain the current structures and spending on Social Security and Medicare. Biden proposes a wide array of spending increases on social issues, while Trump has alluded to cutting spending on social issues but doesn’t specify any cuts. Biden proposes cuts in real defense spending in his Fiscal Year 2025 budget proposal, while Trump states the objectives of strengthening and modernizing defense but doesn’t provide any specific proposals or weigh in on defense spending implications.

Both Biden and Trump propose higher tariffs, with similar objectives, particularly on imports from China, although Trump’s proposals are more aggressive, based on his aversion to bilateral trade deficits with other nations.

On immigration, Trump proposes sharp cuts in immigration and has stated that he endorses the deportation of millions of undocumented immigrants, and a temporary “pausing” of Green Card grants for legal immigrants. Currently, the Biden platform is in flux, with new limitations imposed last month on immigrants.

Biden’s platform includes its recent climate and green agenda accomplished through regulations and tax credit subsidies and regulations that limit drilling. Trump is pro-fossil fuels and gas exploration, and anti-green and climate initiatives, but his platform does not provide specific proposals that would accomplish these objectives.

Both candidates say they will lower inflation. Biden proposes caps on select prices of pharmaceuticals and administrative efforts to lower corporate prices and fees. Trump does not provide specific proposals.

Regarding the Federal Reserve, both candidates favor low interest rate policies, but neither candidate’s platform includes any proposal that would affect the Fed’s conduct of monetary policy. Jerome Powell’s tenure as Fed Chair expires in Spring 2026, and the president will nominate Powell’s successor and any other Fed governors when the positions open. Biden’s short list for Fed Chair apparently includes noted doves Austen Goolsbee and Lael Brainard. Trump has been an outspoken critic of the Fed and his advisors have discussed the idea of blunting the independence of the Fed. It is highly uncertain how this would be accomplished.

Discussion of the Comparison

Several observations about the candidates’ economic platforms are important.

First, both President Biden’s and former President Trump’s platforms basically ignore the current and projected persistent budget deficits and mounting government debt. Both candidates are explicit in supporting the current Social Security and Medicare programs, two of the largest sources of mounting deficit spending and debt projections, while Biden proposes ongoing increases in spending and Trump recommends tax cuts. Based on the two platforms, neither candidate has the appetite for proposing meaningful deficit cutting legislation, so the prospects for meaningful reductions in projected deficits and debt seem slim.

Second, Congressional outcomes will have a large impact on the achieved economic policies of the next president. A Biden victory and Democratic control of both the House and Senate would likely result in sizable spending and tax increases, potentially including a “wealth tax.” A Trump victory and Republican sweep of Congress could potentially lead to jarring spending cuts and shifts in trade, immigration, and regulatory policies well outside of current expectations. Split powers presumably would mitigate against sharp shifts in economic policies that Congress can control.

Third, as presidents, both candidates have made extensive use of Executive Orders and regulations to implement desired policies on a wide array of issues, including international trade, labor, motor vehicles, corporate structure and mergers, and more. Both have used such executive powers to reinterpret rules and laws to achieve desired outcomes, and both have used Executive Orders and regulations to avoid Congressional debate and voting. A split in political powers — either between the executive branch and Congress, or between the House and the Senate — would likely lead to even more extensive use of such executive powers.

Fourth, recent history shows that while some presidents have successfully pursued the economic platforms spelled out during their election campaigns, others have not. Those that did: President Reagan (1980-1988), whose campaign emphasized pro-economic growth policies including tax cuts and a defense spending buildup; President Obama (2008-2016), who campaigned on economic redistribution (spending increases on social issues and higher taxes on high income taxpayers) and receding U.S. foreign influences. Those that didn’t: President Bush (1988-1992) who raised taxes after campaigning against them (read my lips: no new taxes); President Clinton (1992-2000), who supported NAFTA and welfare reform after campaigning strongly against them; and President George W. Bush, who passed significant spending increases, and following 9/11, led the U.S. to become the world’s policeman, after campaigning as a fiscal conservative and international isolationist. As presidents, both Trump and Biden pursued the major themes of their economic platforms when they were in office. Trump’s economic platform in 2016 focused on tax cuts and high tariffs, and anti-China policies; and President Biden’s 2020 campaign emphasized more spending for social issues and green initiatives and higher taxes on high income taxpayers and redistribution and pro-labor initiatives. It’s impossible to know what the next administration will bring, but based on precedent, we can anticipate that these two candidates will attempt to pursue their platforms if they are elected.

Biden-Trump Platform Comparison Summary