The lead stories in 2023 were the resilience of the U.S. consumer and the economy that dispelled concerns about recession and lifted expectations about sustained growth; a decline in headline and core inflation that reduced inflationary expectations, despite the damages of stemming from the high level of prices; and the Federal Reserve’s associated shift from higher-for-longer forward guidance to signaling that it will lower interest rates in 2024, which powered a late-year significant decline in yields.

The big economic issues in 2024:

- Will the economy merely simmer down or fall into a mild recession, and how will the Fed respond to the data in real time? The highest probability is a soft-landing or a recession that is sufficiently mild, with temporary fractional decline in activity and only modest rise in unemployment, such that the upward trajectory of growth is barely interrupted.

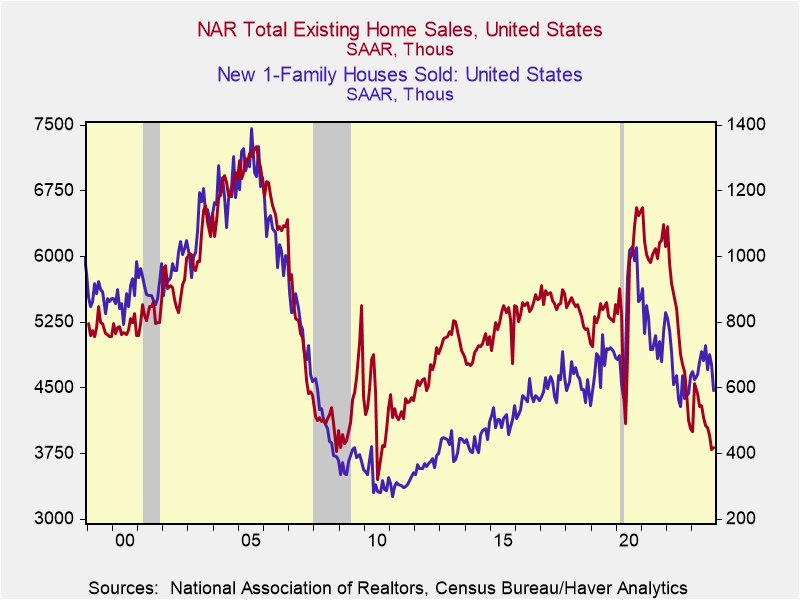

- Consumption and employment are important, but so is housing, which is expected to get a bounce from the recent decline in mortgages. Moreover, ongoing increases in government purchases will continue to boost growth and stimulate private business investment.

- Any back up in inflation, even if temporary, would surprise both the Fed and the markets, with adverse consequences.

- The Presidential election and its policy implications loom large, but this brief does not address the political polls or speculation on the outcome.

- Although Russia’s aggressions against Ukraine and the Hamas-Israel war in 2023 did not material affect financial markets, these are critically important issues that may affect economic and financial performance in 2024.

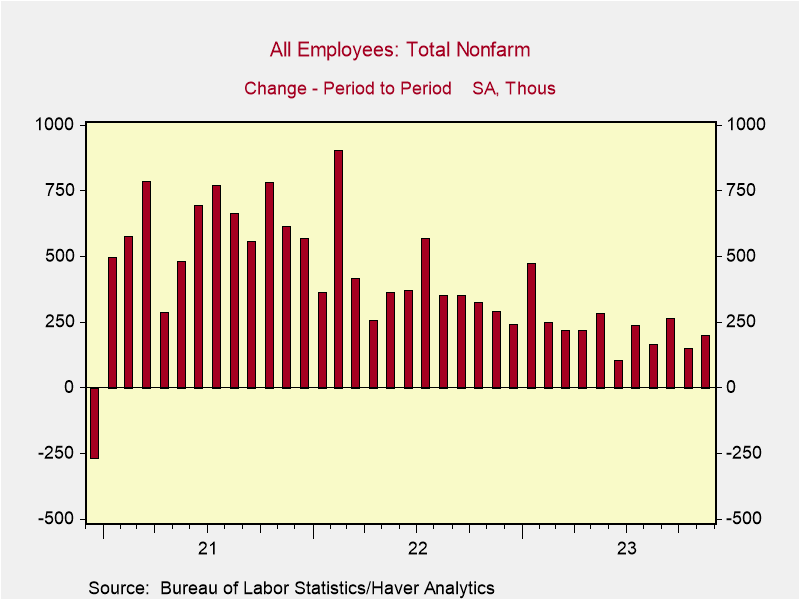

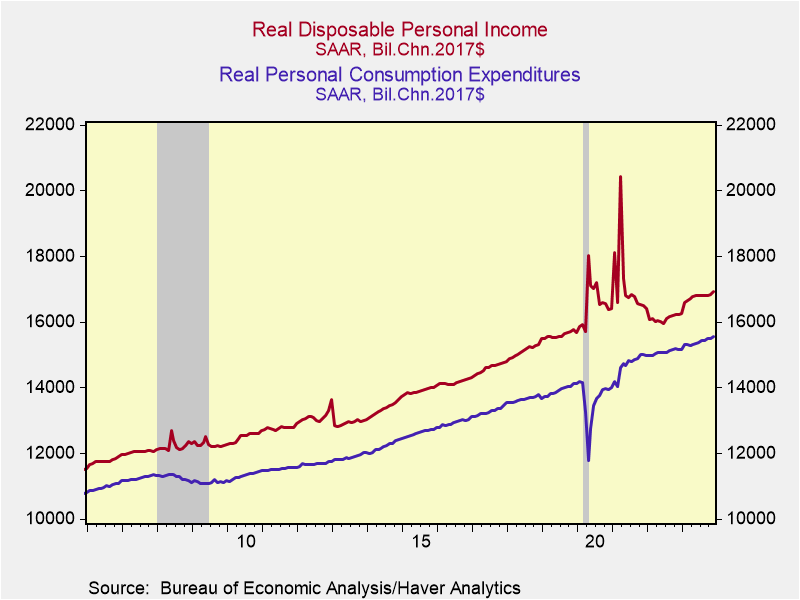

Employment and Consumption Issues. Growth in employment and consumption remained healthy through November. Payroll gains in October-November were a touch lower than its average monthly gain over the last five months (175,000 vs 200,000) while real consumption simmered down following its unsustainable 3.1% annualized growth in 2023Q3, and is on track for 2% annualized growth in Q4 (Charts 1 and 2). Both employment and consumer spending are expected to slow materially in early 2024, but not fall for any sustained period. Such a natural adjustment would not be jarring.

Businesses have managed their operations efficiently, avoiding excesses in employment and inventories, and have record-breaking cash on hand. While employment gains are expected to simmer, large cuts are unnecessary. Consumption is being driven by the strong rise in real disposable personal income (up 4.25% yr/yr), which is getting a boost from the lower energy costs and headline inflation. Moderating job gains will dampen the pace of growth while lower costs of borrowing are expected to lift sales. On average, household balance sheets are solid, with high and rising household net worth lifting the propensity to consume (“Consumption and Household Net Worth,” December 21, 2023).

Amid these positives, pockets of stresses are clearly emerging, with marked increases in delinquencies on servicing debt on auto and credit card loans, despite low unemployment and few job layoffs. This deserves scrutiny. However, 65% of consumption is consumption of services, whose growth tends to be quite stable, in part because measurement of its two largest components—costs of shelter and health care—are imputed. Not to understate the financial stresses facing the underemployed and lower- and middle-income earners, their spending constitutes a relatively small portion of total discretionary spending and consumption, and banks are adequately capitalized to write off nonperforming consumer loans.

As 2024 unfolds, important data releases will set the tone for the highly data dependent Fed and financial markets. Auto sales during December will be released Wednesday January 3. Most importantly, the December Employment Report will be released Friday. The risk is weaker-than-expected (consensus, +170,000) job gains: November’s 199,000 increase was lifted by the return to work of 30,000 UAW workers and 50,000 government job gains; the employment index in the November ISM manufacturing was weak (45.8) and the ISM for services was soft (50.3); and large distribution companies indicated that they added fewer seasonal employees than in either 2021 or 2022.

Housing sales were constrained in 2023 by insufficient supply (particularly of existing homes due to low mortgage rate lock ins), the rise in mortgage rates to 8.2% through late October and the low affordability. In November, existing home sales fell to a 3.82 million annualized pace, down 40 percent from late 2021 highs and close to the depressed lows recorded in 2010 following Great Financial Crisis, while new home sales were 14% below their 2019 average (Chart 3). The sharp decline in the 30-year conventional mortgage rate to 7% from 8.2% in late October is expected to loosen up supply and demand for housing and increase sales. Housing punches above its weight in GDP, adding to construction employment and consumption of household durables.

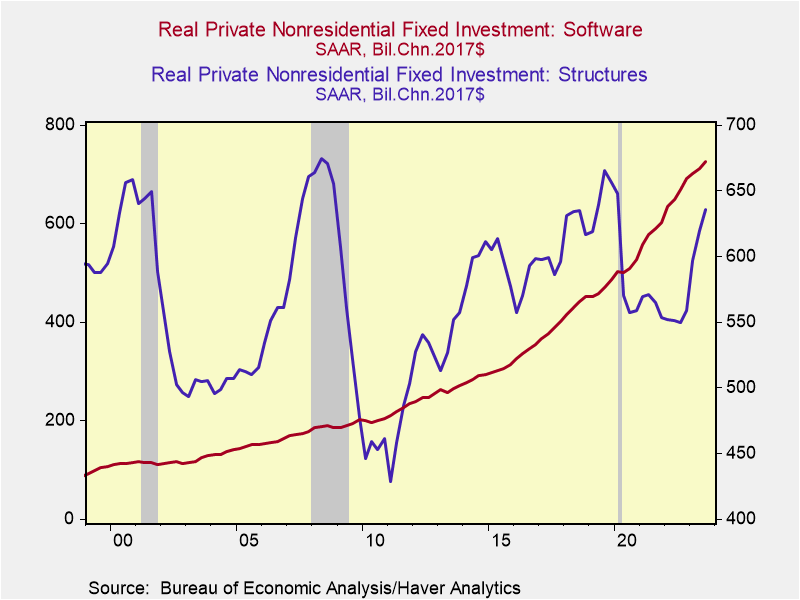

Business Investment and Government fiscal stimulus. Of note, despite ongoing woes in commercial real estate in large cities and lackluster business investment in equipment (highlighted by declines in information processing and industrial equipment), business investment in structures has risen dramatically, by 15.7% since 2022Q3. This reflects strong business responses to the government’s 25% tax credit for building facilities to manufacture computer chips, batteries and green-related equipment through the CHIPS Act and other government subsidies. Based on the projects underway, and the government’s array of tax credits and subsidies of the Inflation Reduction Act, business investment in structures is likely to continue in 2024.

In addition, business investment in software for developing technological innovations and improving efficiency in businesses in a wide array of sectors continues to soar. It has risen 42.4% in the last three years through 2023Q3 and is expected to continue rising in absolute terms and as a percent of total business fixed investment.

In addition to its incentives that stimulate private sector investment, government purchases—consumption and investments that absorb national resources–continue to rise rapidly. These purchases add directly to GDP and generate jobs in both the public and private sector. In the four quarters ending 2023Q4, a 4.8% rise in real government purchases constituted 27.6% of the 2.9% rise in real GDP. Government purchases include spending on the $1.2 trillion American Infrastructure and Jobs Act if 2021 and increases in Federal spending for defense and national security (it does not include transfer payments; see “Fiscal Policy and the Fed Work at Cross Purposes”, August 9, 2023). The heightened demand for defense spending and the Biden Administration’s political incentives in the Presidential election year suggest that rising government purchases will support GDP growth and jobs in 2024.

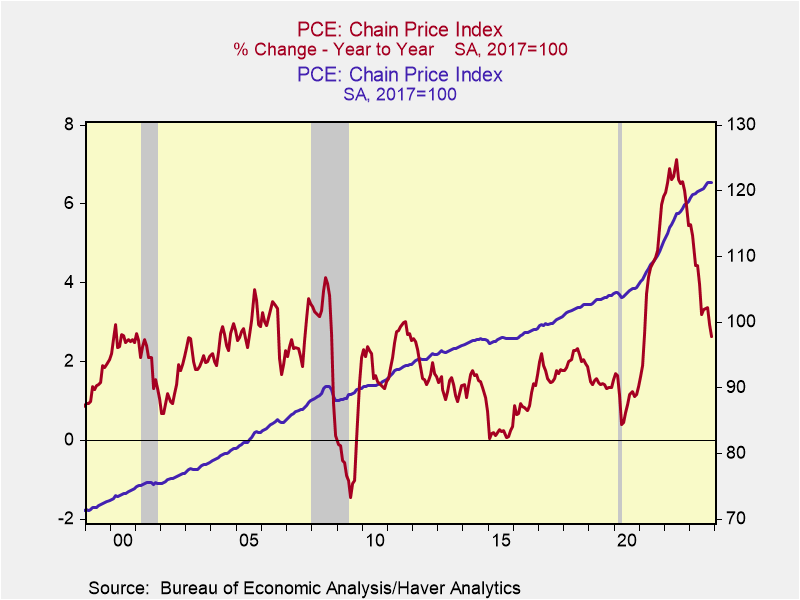

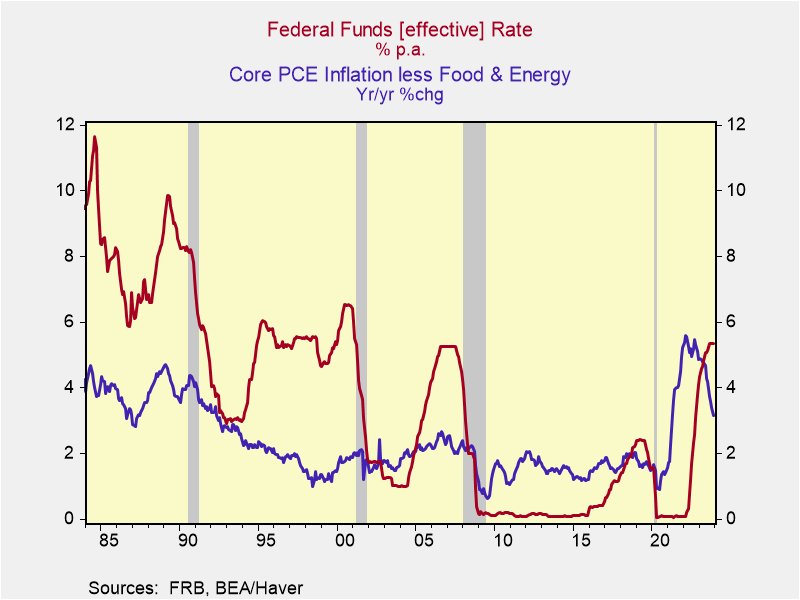

Inflation. Core PCE inflation has fallen significantly in the last year, from 5.1% to 3.2% in November. It is likely to recede further through 2024Q1, reflecting a further ebbing of shelter inflation that is driven by the lagged impact of the Case Shiller home Price Index on rental costs and OER, and the favorable base adjustment from the monthly increases in December 2022-March 2023 that averaged 0.4%.

The Fed has forecast core PCE inflation will reach 2.4% by 2024Q4, which would require a significant slowdown in aggregate demand and nominal GDP growth. Nominal growth is estimated to have slowed in Q4, following its 8.3% annualized surge in Q3, but a further deceleration would be required in 2024. Importantly, in past cyclical episodes in which nominal GDP decelerated sharply, the largest initial impact was on real GDP while inflation responded with a lag. Not so this episode, in which the sharp deceleration in nominal GDP has had its biggest impact on inflation, while real GDP has held up. Cutting inflation substantially further without denting the economy will be more problematic.

The Fed’s inflation forecast for 2024Q4 seems a stretch and financial markets have seemingly bought into this favorable assessment. Any backup in inflation, even if temporary, would be a negative surprise.

The Fed. Several weeks before Fed Chair Powell’s signaled at the press conference following its December FOMC meeting that the Fed would likely begin lowering rates in 2024, Governor Chris Waller stated that if inflation stayed low, the Fed would lower rates to align with the lower inflation. This was a critical point: as inflation has declined, the Fed’s real policy rate has increased (Chart 5). Along with continued declines in M2, this rise in real rates is consistent with restrictive monetary policy. While the Fed wants to continue pursuing a policy consistent with its 2% inflation objective, at least as long as the economy and labor markets perform adequately, it doesn’t want to become inadvertently too tight. In knows that its credibility hinges on both lower inflation and avoiding recession. History shows clearly the Fed responds more aggressively to rising unemployment than it does to rising inflation.

Of note, if the economy continues to show resilience and grow close to estimated potential, even with the Fed funds rate at 5.25%-5.5%, the Fed will likely revise up its estimate of the natural rate of interest (r*), indicating a higher real Fed funds rate is appropriate to achieve its inflation objective. This would signal less aggressive rate cuts.

In real time, the Fed’s decisions will be data dependent. Look for the Fed to begin cutting rates in late spring, but if the economy continues to grow close to its potential path and the unemployment rate remains below its estimated natural rate (which he Fed estimates to be 4.1%, the Fed will not lower rates as the futures markets currently expect.

The Presidential election. Steering clear of speculation about unanticipated turns of events, traditional economic models that estimate the probability of election outcomes rely on the levels and trajectories of employment and the unemployment rate, real disposable personal income and inflation. Currently, the trends favor President Biden’s re-election: real disposable personal income and employment are rising and the unemployment rate is low, and inflation is receding. However, one glaring negative among domestic issues is that while inflation is receding, opinion polls indicate the dramatic rise in the level of prices of goods and services generated by the surge in inflation since early 2021 is cutting into Biden’s support (Chart 6; “We’re Still Paying for the Federal Reserve’s Blunders,” Wall Street Journal, October 26, 2023.)

Finally, the Fed is expected to lie low this election year. That would involve lowering interest rates in response to the softer economic growth and receding inflation, in line with its typical reaction function. This is based on my research of the Fed’s conduct of monetary policy during presidential election years, which shows that with one glaring exception in 1972, the Fed adjusts its interest rates in response to unemployment and inflation conditions during election years in much the same manner as it does during off-election years (“The Fed Won’t Try to Boost Biden,” Wall Street Journal, December 26, 2023).

Chart 1. Nonfarm Establishment Payrolls

Chart 2. Real Disposable Income and Consumption

Chart 3. Existing and New Home Sales

Chart 4. Business Investment in Software and Structures

Chart 5. The Federal Funds Rate and Inflation

Chart 6. PCE Disinflation but Higher Prices