Economic Policy and Financial Insights

January 27, 2026

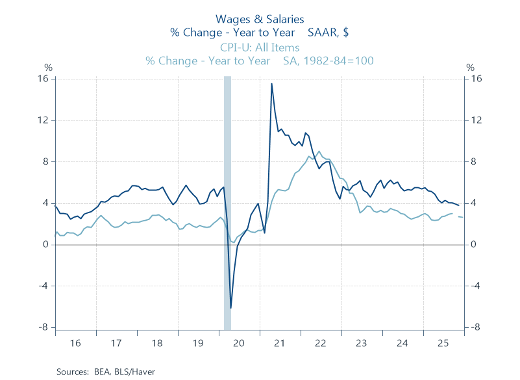

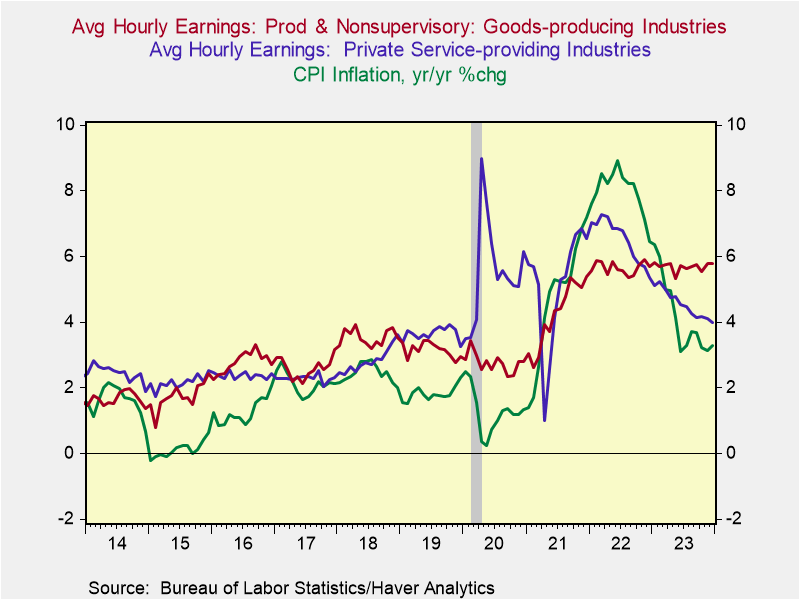

Keep an Eye on Real Wages and Hours Worked in Economy

Following the solid gains in U.S. consumption in 2025, this essay dissects the key factors driving disposable personal income — employment and hours worked, average hourly earnings and income from wages and salaries — and concludes that the growth in consumer spending will continue to grow, but weaker fundamentals point to a moderate pace in 2026.

November 17, 2025

Monetary Policy Responses to Shocks

Here's a paper and presentation that I co-authored with Dr. Michael Bordo and presented at the November 2025 Shadow Open Market Committee meeting. "Monetary Policy Responses to Shocks" analyzes the history of shocks — the Great Inflation of 1965-1982, the Great Financial Crisis and Covid, plus an array of minor disturbances — and how the Fed responds to them. We find that the Fed has responded unsystematically, and often in ways that extend and accentuate the costs imposed by the original shock. The SOMC meeting, the first in its partnership with the Center for Financial Stability, included great presentations on Fed independence, Fannie and Freddie, and financial stresses.

August 22, 2025

Reflections on Jay Powell’s Jackson Hole Speech

Here's an assessment of Fed Chair Jay Powell's speech at the annual Jackson Hole symposium that focuses on how the Fed revised its misguided 2020 Strategic Plan back to its original, balanced Consensus Statement of 2012, and pays tribute to my colleague Charlie Plosser, former President of the Federal Reserve Bank of Philadelphia and a key architect of that 2012 Plan and the Fed's 2% inflation target, who passed away last week.

April 25, 2025

Macro Minds With Kallum Pickering

Here's an interview on the Podcast "Macro Minds," hosted by Kallum Pickering, Chief Economist of PeelHunt, a leading UK investment bank. We discuss the impact of tariffs from a global perspective, and related topics like how the tariffs will impact global trade and how countries have varying degrees of flexibility to negotiate with President Trump. We also review current economic conditions in the U.S., how the Fed may respond and the implications for financial markets, and in light of Trump's erratic behavior, we consider how different scenarios may unfold.

April 8, 2025

An Opportunity to Improve the Fed’s Strategic Framework

Yesterday, the Shadow Open Market Committee's meeting in Washington, D.C. addressed issues of how the Fed may improve its policy framework. Here are a paper and presentation I prepared on the issues with Charles Plosser, former President of the Federal Reserve Bank of Philadelphia. We describe how the asymmetries of the 2020 strategic plan, particularly its FAIT scheme and dropping of preemptive monetary tightening, was driven by the Fed's excessive fears of too-low inflation and the Effective Lower Bound. We recommend restoring symmetry to the strategic framework, in part by re-establishing a clear symmetrical 2% inflation target, and encourage the Fed to consider systematic rules as an input to its discretionary conduct of monetary policy. We recommend many changes to the quarterly SEPs: its infamous dot plot should include a Taylor Rule estimate (dot) of the appropriate interest rate that would achieve the median FOMC economic and inflation projections; information about the Fed's balance sheet; and an annual scenario analysis exercise with alternative projections. In contrast, I'm sure the Fed's currently ongoing strategic review will be a tame and closely controlled review.

October 8, 2024

China’s Stimulus Boosts Markets, but Expected Economic Impact Modest

In reports in recent years, I have described the transition of China’s economic structure and its government-generated excesses in real estate, and warned that its adjustments would dampen its economy for years to come. Everything is unfolding as predicted.

July 19, 2024

A Comparison of the Biden and Trump Economic Platforms

This paper provides a comparison of the economic platforms of Biden and Trump. I purposely do not analyze the economic effects of the platforms or their specific provisions and try to be even-handed in my descriptions (and stay clear of personality and leadership issues). The implications for economic performance, in the U.S. and globally, are important. If there are changes between now and November, I will provide updated analysis.

May 28, 2024

Japan’s Economy, the Yen, and the Bank of Japan

The Bank of Japan's policy of zero interest rates and ongoing asset purchases while inflation is above 2% and inflationary expectations rising is contributing to a weak yen and harming Japan's economy. Raising the BoJ's policy rate and normalizing monetary policy would boost the yen and enhance Japan's economic performance.

May 12, 2024

The Dilemmas Facing the Fed, BoE, ECB, and BoJ

Inflation has receded in the U.S., UK, EuroArea, and Japan but remains above their central banks' 2% targets. This piece assesses the different situations faced by the Fed, BoE, ECB, and BoJ, and considers the appropriate policies that would achieve their objectives and their likely course of action.

March 11, 2024

A Week of Insights into the Economy and Fed Interest Rate Policy

In an article published in the Wall Street Journal last Monday, I argued that there has been a pickup in productivity and sustainable potential real growth, which has raised the natural real rate of interest. These trends imply that the Fed’s real policy rate of 2.6% (the Fed’s current target of 5.25%-5.5% minus the 2.8% core PCE inflation) is not as restrictive as the Fed perceives, limiting the magnitude of interest rate cuts appropriate to achieve the Fed’s 2% inflation target. The Fed’s view, as reflected in Fed Chair Powell’s testimony on the Fed’s semiannual Monetary Policy Report (MPR) to Congress, is that monetary policy is restrictive and will generate a significant slowdown in economic growth below potential that will lower inflation to 2%. Following this, important data releases throughout the week confirmed the continued health in labor markets and strength in household balance sheets that will support ongoing consumer spending. Later in the week, I also had the honor of discussing these issues with Larry Summers at an investment conference in Phoenix, Arizona. His views on the economy, real interest rates, and the Fed were similar with mine — and capped off a week full of insights.

January 21, 2024

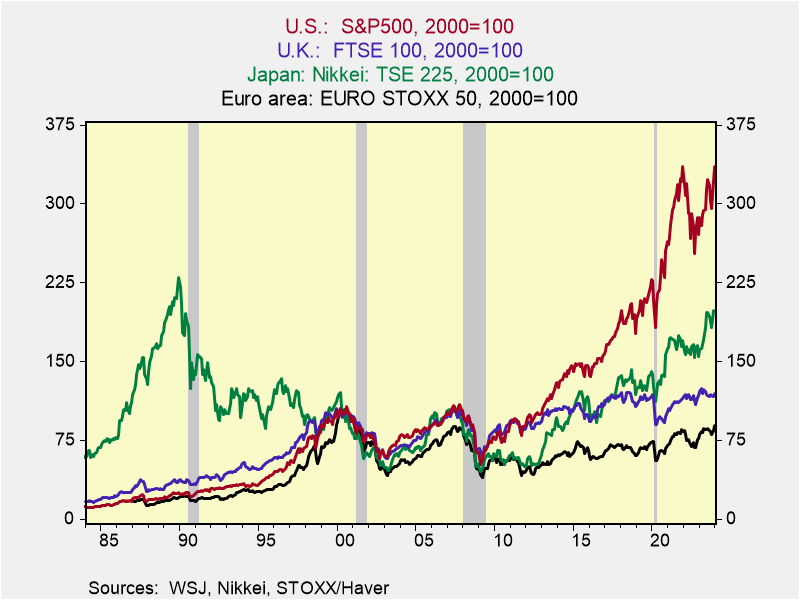

U.S. GDP, Profits, and the Stock Market

The U.S. stock market continues to outperform leading overseas markets, reflecting stronger economic growth and the rise in profits, and the expectations that these innovation and technology-drive trends will continue. In anticipation of this Thursday’s GDP Report, which is expected to record another healthy gain in U.S. GDP in 2023Q4, this brief assesses the longer-run trend in the U.S. economy and profits and highlights some important evolving trends.

January 14, 2024