Articles and Publications

February 1, 2026

Bowing to the Affordability Mirage

This is a Barron's Op-Ed that I co-authored with Michael Bordo. It describes the inconsistencies of policymakers, including the White House, the Fed, and Congress, who urge affordability but pursue it with policies that will fail and only distort behavior that harm economic performance. Price and interest rate controls and other micromanagement policy tools cannot overcome macroeconomic mismanagement.

January 12, 2026

“Stable” Job Market Shows Economy “Doing Okay;” Inflation Likely to Fall in 2026

Here's an interview I did on the Central Bank Central Podcast, hosted by Kathleen Hays. We discuss a wide array of economic and inflation issues and consider the Fed's next moves in monetary policy. We also consider why potential nominees to the Fed Chair by President Trump favor lower interest rates, and what may be the limitations to lower policy rates.

December 12, 2025

The Fed Needs to Earn Its Independence. Just Setting Rates Isn’t Enough.

Here's an article I co-authored with Professor Amit Seru at Stanford University's Graduate School of Business and Senior Fellow at the Hoover Institution. It sets out specific recommendations for how the Fed can reorganize and improve its efforts to maintain financial stability, including obtaining and monitoring information on private credit, while becoming more transparent and accountable in its efforts to achieve its dual mandate of low inflation and maximum employment.

October 1, 2025

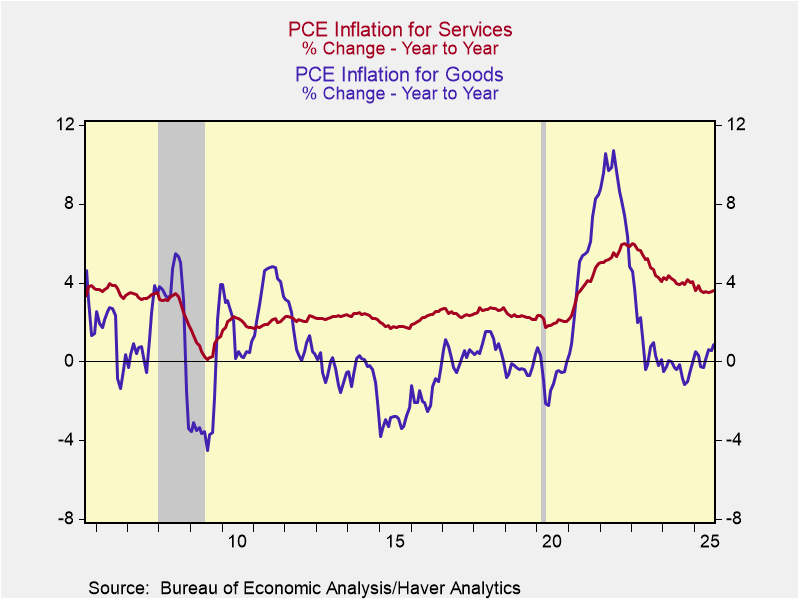

Fed Rate Cuts May Stop as Spending Fuels Growth, Keeps Inflation Rising

Here's a Podcast of my guest appearance on Central Bank Central hosted by Kathleen Hays. In it, I discuss the resilience of the economy and point out that inflation in the services sectors are the primary source of sticky inflation, not goods prices as a consequence of tariffs. I also describe inconsistencies in Fed Governor Miran's assessment that r* is close to zero, suggesting there is little room for the Fed to lower rates unless the economy unexpectedly weakens.

September 15, 2025

Trump Forces a Fed Guessing Game

The Fed has clearly signaled that it will lower interest rates, but is this the proper monetary policy? In this Wall Street Journal op-ed, I discuss the dilemma facing the Fed, with inflation well above the Fed's 2% target while President Trump's tariffs and immigration clampdown are generating market weakness and higher prices. While an easing of monetary policy would support aggregate demand, it would not offset the distortions and inefficiencies of these misguided policies, and may raise inflationary expectations and harm the US dollar.

August 13, 2025

Levy Sees Trump Nominee Miran Pushing for Radical Changes in Governance of Fed

Here's a Podcast I did with Kathleen Hays on her Podcast Central Bank Central. We dig into some issues that will emerge when the Senate Banking Committee holds confirmation hearings on Stephen Miran, President Trump's nominee to be a Federal Reserve Governor. While financial markets are focusing on whether Miran's favoring lower rates may tilt the Fed toward monetary easing, far more important is Miran's dramatic proposals to reform the Federal Reserve's governance that could materially change its monetary policy deliberations as well as bank supervision and regulation.

July 24, 2025

What the Federal Reserve Can Do to Help Itself

Here's a new Wall Street Journal commentary piece by By Charles I. Plosser and Mickey D. Levy: President Trump’s threat to nominate a new Federal Reserve chairman who will lower interest rates is misguided. History suggests that the economy and financial markets perform best when the Fed prioritizes price stability, and performance suffers when other goals take precedence. A central bank operating independently generates the best outcomes.

April 25, 2025

Trump’s Tariffs Capture a Plethora of Historic Mistakes

Here's a presentation on tariffs I made with my colleague Michael Bordo at a Hoover Institution Economic Policy Workshop. Mike describes how Trump's tariffs policy ignores the important lessons of history that tariffs are costly mistakes. In the second half of the presentation, I describe the likely adverse impacts of tariffs on the economy, financial markets and the Fed, with a focus on the potential high costs of a loss of U.S. government credibility and reliability. I conclude with a scenario analysis of Trump's tariff policies and speculate on probable outcomes.

March 17, 2025

A Trade War Puts Pressure on the Federal Reserve

Wall Street Journal Commentary: Mickey D. Levy and Michael Bordo describe how the negative shock of President Trump's tariffs is on a collision course with the Fed's dual mandate. History suggests that the Fed will likely ease monetary policy in response to the negative impacts of the tariffs on the economy and labor markets, but doing so may elevate inflation even higher and compound the costs of the tariffs.

March 5, 2025

Levy Sees Uncertainty Weakening Demand and Lowering Inflation Despite Tariffs

Here's a podcast interview on Central Bank Central with Kathleen Hays and Mickey Levy. In it, they discuss the implications of the tariffs for the economy and inflation, and how this will affect the Fed's perception of the balance of risks as it deliberates on monetary policy.

March 2, 2025

Tariffs and Threats—Will the Fed Be Next?

This is a paper Mickey Levy co-authored with Michael Bordo that was published by the Hoover Institution in its Defining Ideas series. We describe the analytical flaws and misperceptions underlying Trump's preference for tariffs, discuss their expected effects, and express concerns that Trump's next move may be to pressure the Fed to lower rates or maybe manage the US dollar through Treasury-Fed currency intervention. Both activities would be dangerous, and we urge members of Congress on both sides of the political aisle to support the independence of the Fed.

December 21, 2024

An Evenhanded Analysis of Trump’s Economic Policies

In this new Hoover Institution Defining Ideas article, I assess possible impacts of deregulation, lower tax rates, and tariffs. Drawing on the history of Trump’s first term, an evenhanded assessment of the four pillars of Trump’s current economic platform — higher tariffs and tough anti-China policies; extending the 2017 tax cuts; deregulation and increasing government efficiency; and deporting immigrants — suggests that there will be offsetting pluses and minuses. The net economic impacts are most likely somewhere in between the most pessimistic prognostications and the rosy scenario envisioned by the Trump team. There are many key uncertainties and risks.